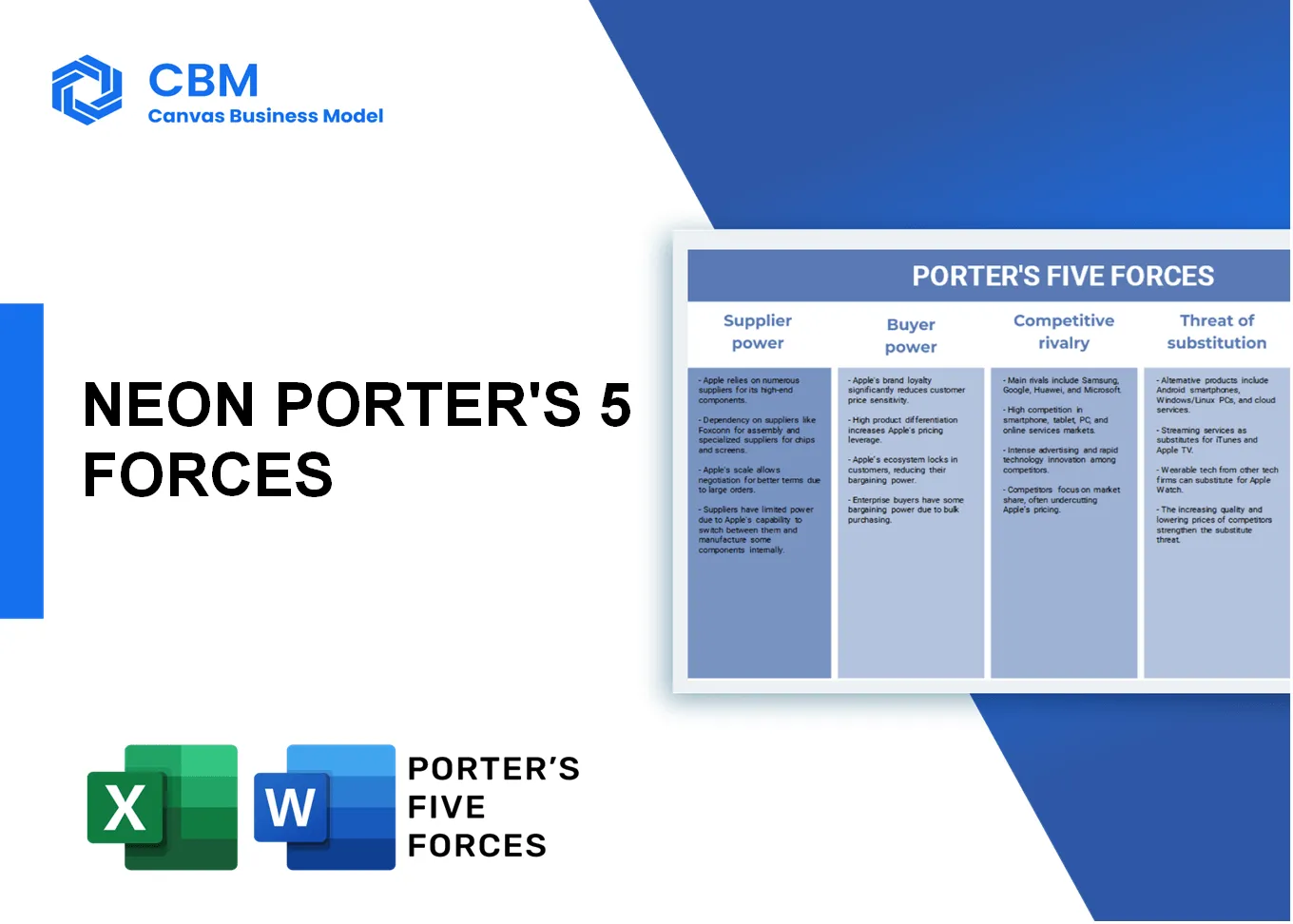

In the rapidly evolving landscape of digital banking, understanding the dynamics at play is crucial for any player in the industry. Neon, a prominent digital bank, navigates several competitive forces that shape its strategic decisions. From the bargaining power of suppliers and customers to the threat of substitutes and new entrants, each aspect plays a vital role in defining how Neon positions itself in the market. Dive deeper to explore how these forces impact Neon and the broader digital banking ecosystem.

Porter's Five Forces: Bargaining power of suppliers

Limited number of banking technology providers

Neon operates in a market characterized by a small number of specialized banking technology providers. As of 2023, it has access to approximately 10 key technology providers that dominate the Brazilian fintech landscape.

Dependence on IT systems and software for operations

Neon’s operations are heavily reliant on sophisticated IT systems, with an estimated 35% of its total operational costs attributed to software licensing and IT services. This dependency creates a significant barrier in negotiating better terms with suppliers.

High switching costs with existing vendors

Switching costs associated with changing IT vendors are notably high. The estimated cost for Neon to switch providers is around R$ 2 million due to integration, training, and potential operational disruptions. This creates a reluctance to switch, reinforcing supplier power.

Supplier differentiation in technology solutions

Technology providers often offer differentiated products tailored for various banking needs. This results in a varied and specialized service offering that gives suppliers leverage over bank clients. In 2022, Neon reported that approximately 60% of its IT solutions were sourced from three specialized developers.

Potential for suppliers to integrate services

Many of Neon’s suppliers are expanding their service offerings, which increases their bargaining power. The market trend indicates that around 45% of suppliers are considering integrating additional services such as cybersecurity and AI-driven analytics into their product suites, thus increasing dependency on their respective technologies.

| Supplier Type | Provider Count | Estimated Switching Cost (R$) | Market Share (%) | Percentage of IT Solutions Used (%) |

|---|---|---|---|---|

| Banking Technology Providers | 10 | 2,000,000 | 35 | 60 |

| Software Licensing | 5 | 500,000 | 20 | 25 |

| Cybersecurity Solutions | 3 | 1,000,000 | 15 | 15 |

| AI/Analytics Platforms | 4 | 750,000 | 10 | 35 |

[cbm_5forces_top]

Porter's Five Forces: Bargaining power of customers

Increasing consumer awareness of digital banking options

The digital banking sector has experienced significant growth, with approximately 60% of Brazilian consumers aware of digital banking options as of 2022. According to a 2021 survey by the Brazilian Federation of Banks (FEBRABAN), around 40% of bank account holders in Brazil were using digital-only banks, representing an increase from 25% in 2019.

Low switching costs for customers among digital banks

Switching costs in the digital banking sector are notably low. Institutions such as Neon have simplified processes that allow users to change banks without incurring significant fees. For instance, a 2021 consumer study showed that 74% of digital bank customers acknowledged they would switch banks if not satisfied with services. The launch of instant account opening features in the sector has heightened this trend, reducing traditional barriers.

Availability of comparison tools for financial products

Numerous comparison tools are available, such as Serasa and Buscapé, allowing customers to evaluate different financial products effectively. As of 2022, these tools reported a surge in user engagement, with about 30% of prospective borrowers using them to assess personal loans and credit card offers. This trend empowers consumers to make informed decisions, amplifying their bargaining power against banks.

Customers seek competitive interest rates and fees

Competitive pricing is crucial for customers. Neon offers personal loans with interest rates starting as low as 1.9% per month, while the Brazilian average for personal loans was reported at 2.75% in the first quarter of 2023, according to the Central Bank of Brazil. This price sensitivity is reflected in research showing that 65% of consumers prioritize rates when choosing a financial institution.

Strong demand for personalized services and digital experiences

According to recent industry reports, approximately 80% of consumers express a preference for personalized banking experiences. A study by McKinsey indicated that financial institutions that tailored their services improved customer satisfaction scores by as much as 15%. Neon, catering to this demand, has integrated features like personalized investment advice, showcasing the growing expectation for individualized services in the digital banking sphere.

| Factor | Statistic/Info | Source |

|---|---|---|

| Consumer awareness of digital banking | 60% | FEBRABAN 2022 |

| Digital bank users in Brazil | 40% | FEBRABAN 2021 |

| Likelihood of switching banks | 74% | 2021 Consumer Study |

| Users of financial comparison tools | 30% | 2022 Research |

| Neon personal loan rate | 1.9% month | Neon Financial Products |

| Brazilian average personal loan rate | 2.75% | Central Bank of Brazil Q1 2023 |

| Demand for personalized banking | 80% | Industry Reports |

| Improvement in satisfaction with personalized services | 15% | McKinsey Study |

Porter's Five Forces: Competitive rivalry

Presence of numerous digital banks and fintech companies

The Brazilian digital banking landscape is highly competitive, with over 30 digital banks operating in the market. Notable players include Nubank, Banco Inter, and Banco Original. As of 2023, Nubank has over 70 million clients and a valuation of approximately $45 billion.

Traditional banks entering the digital space

Established banks such as Itaú Unibanco, Bradesco, and Santander have launched their digital platforms to compete with fintech firms. For instance, Itaú's digital service, Itaú Digital, reported over 10 million users as of Q1 2023. Bradesco’s digital offerings include the Bradesco Next, targeting younger customers with tailored services.

Aggressive marketing and customer acquisition strategies

Digital banks are deploying aggressive marketing strategies to attract customers. For example, Neon has invested approximately $40 million in marketing campaigns in 2022, resulting in a 50% growth in new account openings compared to the previous year. Competitors are also heavily investing in digital advertising, with Nubank spending around $25 million annually on social media marketing.

Innovation-driven competition in product offerings

Neon and its competitors are focusing on innovative product offerings. Neon launched its investment product, Neon Invest, in 2021, garnering over 1 million users within the first year. Meanwhile, Nubank introduced a cryptocurrency trading feature in 2022, capitalizing on the growing interest in digital assets.

Differentiation based on user experience and technology

In the digital banking sector, user experience is a critical differentiator. Neon has a customer satisfaction score of 89%, according to a 2023 survey by Reclame Aqui, which aggregates customer feedback. The average app rating for Neon on Google Play is 4.8 stars, significantly higher than the average for traditional banks, which hovers around 3.5 stars.

| Bank Name | Number of Users | Valuation (USD) | Marketing Spend (USD) | Customer Satisfaction Score |

|---|---|---|---|---|

| Nubank | 70 million | 45 billion | 25 million | 85% |

| Itaú Unibanco | 10 million (digital) | 17 billion | N/A | 82% |

| Bradesco | 6 million (Bradesco Next) | 12 billion | N/A | 80% |

| Banco Original | 3 million | 1 billion | N/A | 78% |

| Neon | 8 million | 1.5 billion | 40 million | 89% |

Porter's Five Forces: Threat of substitutes

Availability of alternative financial services (peer-to-peer lending)

The peer-to-peer (P2P) lending market has been expanding rapidly. According to a report by Statista, the global P2P lending market volume reached approximately USD 67 billion in 2021 and is projected to grow at a CAGR of 25% from 2022 to 2028. In Brazil, as of 2022, P2P lending platforms facilitated around BRL 1.3 billion in loans, demonstrating substantial competitiveness against traditional banks.

Growth of cryptocurrency and blockchain-based finance

The cryptocurrency market size was valued at around USD 1.49 trillion in 2021 and is expected to reach USD 4.94 trillion by 2030, with a CAGR of 14.8% during the forecast period. Brazil ranks fifth globally in the number of cryptocurrency users, with approximately 10 million active users as of early 2023. This growth represents a significant challenge to conventional financial services.

Emergence of non-bank financial institutions

Non-bank financial institutions have gained traction, representing about 30% of the total lending market in Brazil as of 2022. Companies like PagSeguro and C6 Bank have carved out substantial shares of the market, with PagSeguro reporting revenues of BRL 6.1 billion in 2021. These institutions provide users alternatives to traditional banking options.

Mobile payment solutions challenging traditional banking

Mobile payment solutions like PicPay and Mercado Pago processed a total of BRL 497 billion in transactions in Brazil in 2022, showcasing immense competition for traditional banks. The number of mobile payment users in Brazil reached approximately 67 million, further escalating the challenge to Neon's services.

Increased reliance on apps for personal finance management

According to a survey conducted by the Brazilian Institute of Geography and Statistics (IBGE), around 45% of Brazilian adults actively use financial management apps. The total expenditure on personal finance applications in Brazil was estimated at BRL 2 billion in 2022, representing a growing trend of users substituting traditional banking services with tech-based solutions.

| Financial Service Alternative | Market Size (2022) | Projected Growth Rate (2022-2028) | Active Users (2023) |

|---|---|---|---|

| Peer-to-Peer Lending | BRL 1.3 billion | 25% | N/A |

| Cryptocurrency | USD 1.49 trillion | 14.8% | 10 million |

| Non-Bank Financial Institutions | N/A | 30% | N/A |

| Mobile Payment Solutions | BRL 497 billion | N/A | 67 million |

| Personal Finance Apps | BRL 2 billion | N/A | 45% |

Porter's Five Forces: Threat of new entrants

Low barriers to entry in the digital banking sector

The digital banking sector has relatively low barriers to entry, allowing new players to establish themselves more easily than in traditional banking. Digital banks can emerge with minimal capital investment due to the digital-first approach, reducing physical infrastructure costs. The global digital banking market size was valued at USD 8.5 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 13.2% from 2022 to 2030.

Access to venture capital funding for startups

According to a report from CB Insights, global fintech funding reached USD 121 billion across 1,081 deals in 2021. In Brazil, investment in fintech startups surged to USD 3.1 billion in the same year. This influx of venture capital funding enables new entrants to launch their operations with substantial backing, contributing to heightened competition in the digital banking space.

Technology advancements lowering operational costs

Technological advancements such as cloud computing, artificial intelligence, and mobile banking solutions significantly lower operational costs. A study by Deloitte found that digital banks operate with 30%-40% lower costs compared to traditional banks due to automation and online service delivery. This cost efficiency creates favorable conditions for new entrants.

Regulatory challenges can deter some entrants

Regulatory compliance presents a barrier for some new entrants. In Brazil, the Central Bank regulates digital banks, requiring them to achieve certain levels of capital adequacy and to comply with anti-money laundering regulations. New entrants must maintain a minimum capital of BRL 1 million to operate legally, which can act as a deterrent for smaller startups.

Niche markets offering opportunities for new players

Niche markets in the fintech sector present lucrative opportunities. For instance, in 2022, the Brazilian market for personal loans grew by 42%, with digital channels capturing a significant portion. As consumers increasingly seek tailored financial services, startups focusing on specific demographic needs, such as students or small businesses, can enter the market with targeted offerings.

| Market Segment | 2021 Valuation (USD) | 2022 CAGR (%) | Key Opportunities |

|---|---|---|---|

| Digital Banking | 8.5 Billion | 13.2 | Low-cost services, accessibility |

| Fintech Investment | 3.1 Billion (Brazil) | N/A | Venture capital support |

| Niche Lending | N/A | 42 (Personal Loans) | Young adults, SMEs |

In the rapidly evolving landscape of digital banking, Neon faces a compelling battleground shaped by Michael Porter’s Five Forces. The dynamics of bargaining power of suppliers and customers heavily influence profit margins and innovation opportunities. Concurrently, the intense competitive rivalry from both digital and traditional banks, alongside the threat of substitutes like cryptocurrency and peer-to-peer lending, requires constant adaptation. Furthermore, the threat of new entrants highlights the need for strategic differentiation in a market where barriers are lowering. As Neon continues to navigate these complexities, leveraging technology and fostering customer engagement will be pivotal in ensuring sustained growth and a competitive edge.

[cbm_5forces_bottom]