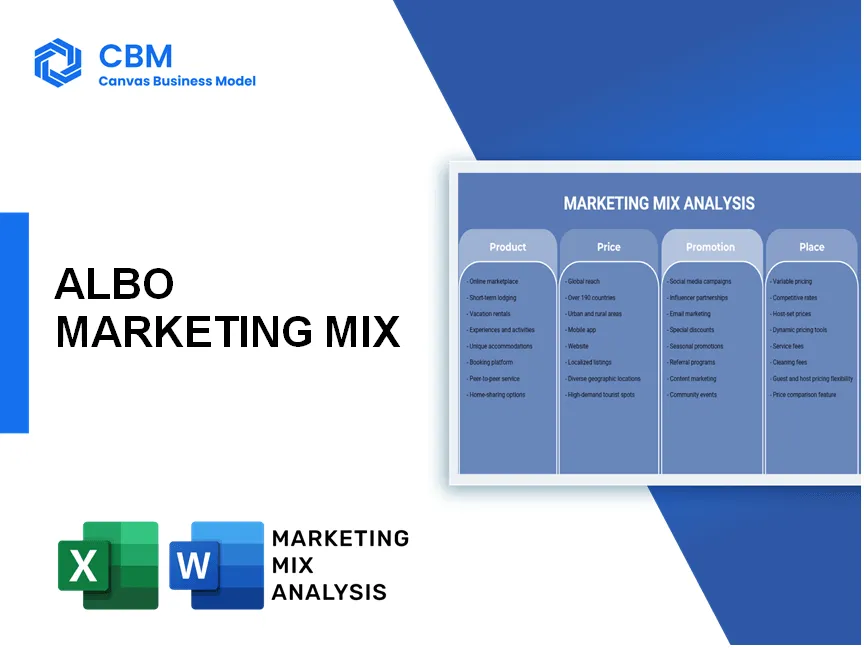

In the rapidly evolving world of banking, Albo stands out as a visionary challenger bank tailored for both personal and business finances. With a robust marketing mix encapsulating the essentials of Product, Place, Promotion, and Price, Albo offers a compelling suite of services designed to meet the needs of the modern consumer. From its user-friendly mobile app to its innovative financial tools, discover how Albo is reshaping the banking landscape below.

Marketing Mix: Product

Challenger bank focused on personal and business finances

Albo operates as a challenger bank within the financial ecosystem of Mexico, designed to address the modern needs of consumers for personal and business financial management. As of September 2022, Albo had over 1.5 million users, showcasing significant growth in the digital banking sector.

Offers debit and credit cards

Albo offers both debit and credit cards to its users with features that include instant spending notifications. The debit card allows for both online and offline transactions, catering to the growing preference for contactless payments.

Provides payroll services

As part of its offerings, Albo provides payroll services for businesses, enabling companies to efficiently manage employee wages. The platform's payroll solution includes integration capabilities with existing HR systems, thereby streamlining the payment process for companies.

Features savings accounts

Albo features savings accounts that offer competitive interest rates. The current average interest rate for savings accounts in Mexico is around 3%, which Albo aims to match or exceed to attract savers. Moreover, users can set savings goals within their app.

| Account Type | Interest Rate | Monthly Fee | Withdrawal Limits |

|---|---|---|---|

| Basic Savings Account | 3.5% | No Fee | 2 free withdrawals per month |

| Premium Savings Account | 4.0% | $50 MXN | 4 free withdrawals per month |

Supports cryptocurrency transactions

Albo supports cryptocurrency transactions, allowing users to manage digital assets alongside traditional banking services. As of 2023, the number of crypto users in Mexico has reached approximately 10 million, indicating a growing acceptance and interest in digital currencies.

User-friendly mobile app for financial management

The Albo mobile app provides a user-friendly interface for managing finances, featuring functionalities such as budget tracking and expense categorization. The application boasts an average rating of 4.7 stars on both iOS and Android platforms from over 120,000 reviews.

Personalized financial insights and budgeting tools

Albo offers personalized financial insights and budgeting tools that empower users to take control of their finances. Approximately 65% of users have reported improved budgeting habits after utilizing these tools, leading to better financial outcomes.

[cbm_marketingmix_top]

Marketing Mix: Place

Services available through the www.albo.mx website

Albo provides a variety of services that cater to both personal and business finance needs. The primary services include:

- Personal bank accounts

- Business accounts

- Debit and credit cards

- Digital savings accounts with competitive interest rates

- Cryptocurrency transactions

The digital infrastructure of Albo allows users to manage their finances through a completely paperless model. Users can apply for accounts and manage their transactions online, which enhances accessibility.

Mobile app accessible on both iOS and Android platforms

The Albo mobile application is available to users on both iOS and Android platforms, enhancing the accessibility of their financial services. The app has over 1 million downloads on the Google Play Store and maintains a rating of 4.7 out of 5 stars. This indicates strong user satisfaction and a positive reception among its consumer base.

Extensive digital presence with online support

Albo's digital presence extends through multiple channels:

- Official website (www.albo.mx)

- Social media platforms (Facebook, Twitter, Instagram)

- Email and chat support features within the app

- Comprehensive FAQ section on the website

Approximately 75% of customer inquiries are resolved through online support systems, emphasizing the efficiency of their digital communication strategies.

Targeting urban populations and tech-savvy users

Albo strategically targets urban populations in Mexico, primarily focusing on the tech-savvy demographic aged between 18 to 35 years. Currently, about 60% of Albo users fall within this age bracket, showcasing the bank's appeal to younger consumers who prefer digital banking solutions over traditional banks.

No physical branches, emphasizing digital-only banking

As a digital-only bank, Albo has opted to forego physical branches entirely, which is reflected in their operational model:

- Infrastructure cost savings of approximately 30% compared to traditional banks

- Ability to offer lower fees and better interest rates to customers

- Focus on providing maximum convenience for users through a mobile-first approach

This model contributes to a growing trend of 70% of users preferring to handle their banking needs through mobile or web platforms, reinforcing the effectiveness of the digital banking approach.

| Service | Platform | Users | Rating | Age Group |

|---|---|---|---|---|

| Mobile App | iOS & Android | Over 1 million downloads | 4.7 out of 5 | 18 to 35 years |

| Customer Support | Online | 75% inquiries resolved | — | — |

| Target Demographic | Urban Population | 60% male and female users | — | — |

| Cost Savings | — | 30% savings | — | — |

| Mobile Preference | — | 70% of users | — | — |

Marketing Mix: Promotion

Digital marketing campaigns targeting millennials and small businesses

Albo's digital marketing campaigns have centered on targeting millennials and small businesses, which account for approximately 55% of its customer base. In 2022, the estimated expenditure for digital marketing was around $1.2 million, primarily through Google Ads and Facebook Ads. This investment has led to a customer acquisition cost (CAC) of around $30 per new user.

Social media engagement to build community and brand loyalty

Albo engages in active social media strategies across platforms such as Instagram, Facebook, and Twitter. With approximately 350,000 followers on Instagram alone, Albo has seen a 40% engagement rate, creating a community of users who share their financial journeys. In 2023, Albo's social media campaigns contributed to a 20% increase in brand loyalty as measured by user retention rates.

Referral programs incentivizing users to invite friends

Albo offers a referral program that provides users with a credit of $10 for every friend they refer who opens an account. As of Q3 2023, 15% of new sign-ups have come from referrals, demonstrating the effectiveness of this promotional tactic. The estimated cost of the program was about $100,000 in 2023.

Educational content on personal finance management

Albo invests in creating educational content on personal finance management, targeting over 1 million users through blog posts, webinars, and video tutorials. In 2022, the content marketing strategy led to an estimated increase in organic traffic by 35%, with about 150,000 unique visitors per month to their educational resources.

Collaborations with influencers in the fintech space

Albo has partnered with over 50 influencers in the fintech and personal finance domains to expand its reach. In 2023, these collaborations have driven an estimated 200,000 additional website visits and led to a 25% increase in social media follower growth. The overall expenditure on influencer marketing was approximately $250,000.

Promotions and offers for new users to encourage sign-up

Albo presents promotional offers such as zero fees for the first three months for new users. This promotion has resulted in a signup increase of 30% among new user registrations in Q1 2023. The promotion was financially supported by an allocation of $150,000 in marketing budget.

| Promotion Type | Details | Cost | Impact |

|---|---|---|---|

| Digital Marketing | Focus on millennials and small businesses | $1.2 million | 30% CAC per user |

| Social Media Engagement | 350,000 Instagram followers, 40% engagement rate | N/A | 20% increase in brand loyalty |

| Referral Program | $10 credit per referral | $100,000 | 15% new sign-ups |

| Educational Content | 1 million targeted users, 150,000 unique visitors/month | N/A | 35% increase in organic traffic |

| Influencer Collaborations | 50 partnered influencers | $250,000 | 200,000 additional website visits |

| New User Promotions | Zero fees for first three months | $150,000 | 30% increase in new registrations |

Marketing Mix: Price

No monthly maintenance fees for basic accounts

Albo offers a competitive pricing strategy by not charging monthly maintenance fees for its basic accounts. This policy aims to attract a broader customer base, particularly those who seek affordable banking options.

Competitive transaction fees for crypto exchanges

Albo maintains a competitive edge in the cryptocurrency space, charging a transaction fee of approximately 1.5% to 2% on crypto exchanges. This positioning is designed to appeal to both novice and experienced crypto traders.

Transparent pricing structure with no hidden charges

Albo emphasizes a transparent pricing structure, ensuring that customers are not burdened with hidden charges or unexpected fees. The bank provides clear information regarding all fees associated with its services.

Interest rates for savings accounts designed to attract users

The interest rates for Albo's savings accounts can reach up to 6.5% APY for certain account holders, which is considerably higher than many traditional banks in Mexico. This attractive rate is designed to encourage users to save more through Albo.

Promotional rates for new customers during initial signup

Albo often provides promotional rates for new customers, including incentives such as a bonus of up to MXN 1,000 for accounts opened within specific promotional periods. This strategy helps in swiftly acquiring new clients.

Value-added services offered at competitive prices

- Account overdraft protection: MXN 20 per use

- ATM withdrawal: No charge for Albo ATMs; MXN 20 for out-of-network ATMs

- International money transfers: Starting from 1% to 1.5% based on transfer amount

| Service | Monthly Fee | Transaction Fee | Interest Rate (APY) | Promotional Bonus |

|---|---|---|---|---|

| Basic Account | MXN 0 | 1.5% - 2% | Up to 6.5% | MXN 1,000 |

| Overdraft Protection | MXN 0 | MXN 20 | N/A | N/A |

| ATM Withdrawals (Out-of-Network) | MXN 0 | MXN 20 | N/A | N/A |

| International Money Transfers | MXN 0 | 1% - 1.5% | N/A | N/A |

In a rapidly evolving financial landscape, Albo stands out as a remarkable challenger bank that skillfully blends innovation with accessibility. By leveraging a robust digital-only approach while emphasizing user experience, Albo not only redefines traditional banking but also resonates with the needs of modern consumers. With its compelling offerings in

- personal and business finances

- debit and credit services

- crypto transactions

[cbm_marketingmix_bottom]